Personal Capital Vs Mint

Mint vs You Need a Budget vs Personal Capital. Jan 10, 2019 by Ada Do Budgeting Personal Debt. Budgeting apps can help users take more control of their money, and can be a great way for people to keep track of their money goals. You Need a Budget (YNAB), Mint, and Personal Capital are three great apps for budgeting.

Table of Contents.Personal Capital has risen to become one of the most popular financial management platforms available. It comes in two versions, the Free Financial Dashboard and the Wealth Management service. The free version is primarily a budgeting application, but it provides abundant tools for investing. The wealth management version is a full investment management service, working somewhat like a robo advisor, but providing a generous amount of live support from financial advisors.

About Personal CapitalPersonal Capital is used by nearly two million people, who primarily use the free version. But the wealth management service takes in more than 18,000 clients, who have more than $8 billion in assets under management. The company was founded in 2009, and is headquartered in San Carlos, California.Most users start out with the free version, then upgrade to the wealth management service if they want direct investment management of their investment portfolios.

But even if you don’t upgrade, the free version offers so many investment tools it’s worth having for those alone. How Personal Capital WorksAs noted at the beginning, offers two versions, the Personal Capital free Financial Dashboard, and Personal Capital Wealth Management. While they’re related services, they provide very distinct functions.

Let’s take a look at each individually. Personal Capital Free Financial DashboardThough this version is often seen primarily as a budgeting app, it’s actually fairly limited in that regard. However, the investment tools are extensive.

Personal Capital Vs Mint Bogleheads

Even if you have no intention of using Personal Capital for budgeting, the free version will provide valuable investment support.The dashboard serves primarily as a financial aggregator, where you can include all your accounts. That includes investments, savings, checking, loan accounts and credit cards. It allows you to assemble your entire financial life on a single platform. You can even include any employer-sponsored retirement plans you have–in fact, this is the free version’s specialty.

DashboardThe free Financial Dashboard offers the following capabilities:Budgeting. You can use the free version to track your cash flow and spending patterns. You can also analyze your spending categories and individual transactions. You’ll get monthly summaries, helping you to know exactly where your money is going. However, if you’re looking primarily for budgeting software, you probably won’t use Personal Capital. For example, while the platform provides alerts of upcoming bills, it does not provide a bill payment function.

You will have to continue to pay your bills directly from your bank accounts.Cash Flow Analyzer. This tool creates a budget for you. Once setup, it tracks your income and expenses from the different financial accounts you’ve linked to the platform. You can then set financial goals, like preparing for retirement, or paying off debt.

The analyzer will help you develop strategies to reach your goals. Cash Flow AnalyzerDespite the Personal Capital Financial Dashboard’s limits on the budgeting side, it’s an excellent service when it comes to investment management. It offers the following investment tools:401(k) Analyzer.

Millions of people participate in employer sponsored retirement plans. But few are aware of the investment fees that are hidden in those plans. The analyzer will show you exactly what each fund in your plan is costing you. It will then suggest alternative allocations into lower cost funds.Retirement Planner. The planner uses a series of “what if” scenarios, to help you determine if you’re on track with your retirement goals.

You can adjustment for changes in your situation, such as a job or career change, the birth of a child, or even saving for college. It takes into account outside factors that can have an impact on retirement.See also:Investment Checkup. This might be the most important investment tool of all. Once you aggregate your investment accounts on the platform, this tool will help you to optimize those accounts. It can recommend adjusting your portfolio mix to improve your overall investment performance.Net Worth Calculator.

By tracking your assets and liabilities, you can quickly determine your net worth. That’s important, because net worth is the most significant number in determining your overall financial strength.Personal advisor. Even though the Financial Dashboard is free to use, you’ll still have the ability to contact a personal advisor.

The advisor won’t be able to provide investment advice, but they can help you with questions regarding the service, as well as provide additional information on any recommendations made by Personal Capital.Try it out: Personal Capital Wealth ManagementPersonal Capital Wealth Management is sometimes grouped with robo advisors, which isn’t entirely true. While they do use significant automated investment tools, there’s also a very strong element of active human management. That really puts the service somewhere between traditional human investment advisors and robo advisors.Similar to robo advisors, Personal Capital starts by determining your risk tolerance, investment goals, and time horizon. But they also consider your personal preferences in constructing your portfolio. Your portfolio is managed according to Modern Portfolio Theory (MPT), by investing across multiple asset classes for proper diversification. They also rebalance your portfolio periodically to maintain target asset allocations.Your portfolio is invested in six asset classes:.

U.S. Bonds. International stocks. International bonds. Alternative investments, including real estate investment trusts, energy and gold. CashThe specific percentage of your portfolio in each asset class will depend on your investor profile, as determined by your risk tolerance, investment goals, time horizon and personal preferences.Each asset class is invested in a low-cost index-based exchange traded fund (ETF), to provide broad market exposure at a low expense ratio.

However, the U.S. Equities portion will be held in a well-diversified sample of at least 70 individual stocks. This allows Personal Capital to provide tactical weighing and tax optimization (read on for an explanation of both services).Investment performance. Wealth Management publishes its investment performance on the website. The performance through 2018 is as follows. Wealth Management PerformanceWealth Management’s Investment Strategies in Greater DetailTactical Weighing. This is an that improves on traditional indexing by maintaining more evenly weighted exposure to each sector and style.

Back tests have indicated the strategy outperforms the S&P 500 by 1.5% per year, and with lower volatility.Tax optimization. This is an investment strategy designed to lower the income tax liability resulting from your investing activities. It’s a strategy using several techniques:. Using ETFs rather than mutual funds, since they generate far less in terms of capital gains. Using individual stocks, since they can be easily bought and sold to generate. Tax allocation is employed in which income producing assets are held in retirement accounts, while capital gains generating assets are held in taxable accounts to take advantage of lower long-term capital gains tax rates.Socially Responsible Investing (SRI). If you choose to incorporate SRI into your investing activities, specific investments are chosen based on their compliance with what is known as environmental, social and governance, or ESG.This means investments are chosen in companies based on their environmental impact, social impact (diversity and labor relations), and management.

Management, or governance, is determined by management structure, board independence, and executive compensation levels. This will give you an opportunity to invest in what you believe in, while avoiding what you don’t.Related: Personal Capital Wealth Management FeaturesMinimum initial investment: $100,000 ($200,000 for regular access to financial advisors)Accounts available. Joint and taxable investment accounts; traditional, Roth, SEP and rollover IRAs; trusts; advice only on 401(k) and 529 plansAccount custodian. Your Wealth Management portfolio will be held with, one of the largest investment custodians and clearing agencies in the world.

The company acts as custodian for more than $1 trillion in assets worldwide.Account protection. All accounts are protected by SIPC, for up to $500,000 in securities and cash, including up to $250,000 in cash. This coverage protects you against broker failure, and not against monetary losses due to market fluctuations.Financial advisors. This is a major part of the Wealth Management service. Financial advisors are available by phone, email, live chat, or web conference on a 24/7 basis. As a client of the Wealth Management service, you’ll have two dedicated financial advisors.

They’ll provide you with full financial and retirement planning, as well as college savings, and financial decision support on such topics as insurance, home financing, stock options, and even compensation.Personal Capital Wealth Management Fees. Fees for Personal Capital Wealth Management are as follows: Asset under managementAnnual advisory feeUp to $1 million0.89%First $3 million.0.79%Next $2 million.0.69%Next $5 million.0.59%Over $10 million.0.49%.Applies to clients who invest $1 million or more. Personal Capital Wealth Management Private Client ServiceAs you’ll see in the screenshot below, Personal Capital’s services have four levels:.

Free – the Financial Dashboard. Investment Service – the basic investment tools and services provided as part of the Financial Dashboard (meaning the Free and Investment Service are both part of the same service level). Wealth Management – for investors with at least $200,000 to invest. Private Client – for investors with over $1 million to investPrivate Client provides a higher level of service for higher asset clients. In addition to offering lower annual advisory fees, you also get priority access to a certified financial planner and other financial professionals, private banking services, estate services, and collaboration with an estate attorney and CPA. Personal Capital Options Additional Personal Capital Features and BenefitsCustomer service.

You can reach Personal Capital by either phone or email, 24 hours a day, 7 days a week. This applies to both the free version and the Wealth Management service, but the Wealth Management service also comes with access to two live financial advisors.Mobile App. The mobile app is available for iOS and Android devices, as well as Apple Watch, and can be downloaded at the App Store or on Google Play.Data export features. There is currently no capability to print reports from the Personal Capital application. They promise the capability is in the pipeline, but cannot provide an estimated time of arrival.However, you can export transactions, but the capability is limited only to the web application. To do so, you need to log into the website using either Chrome or Firefox. You then navigate to Transactions/All Transactions, then click on CSV to export the transactions.Security.

Personal Capital Vs Quicken

Personal Capital uses the following security measures:. The platform is read-only, so no withdrawals or transfers can be made. Two-factor authentication. Requires you to register any devices you use to access the platform. Military-grade encryption (256-bit AES) to keep your data secure.

Firewalls and perimeter security. Continuous monitoring. Fingerprint scanning is available for iOS devices (but not Android)How to Sign Up with Personal CapitalYou can sign up for Personal Capital through the website. You start by providing your email and phone number, then creating a password.You’ll then be asked general information, including your name, age, age at which you plan to retire, and the amount of money you have saved toward retirement. (As indicated throughout this review, Personal Capital has a strong orientation toward retirement.)Once you’ve completed that information, you’ll begin linking your accounts. Personal Capital syncs with more than 12,000 financial institutions, or you can simply enter your institution’s name and web address. Personal Capital will analyze your financial accounts going back from one to three months.

Based on the analysis, you’ll have access to all the tools on the Free Dashboard, as well as Personal Capitals recommendations for your investment accounts.If you want to sign up for the Wealth Management service, you can contact a financial advisor to get the process going (or wait a short while, and one will contact you). You’ll be required to provide additional information, including documentation verifying your identity. You will then need to link one or more financial accounts to transfer funds into your Pershing account, which will hold your investments. Personal Capital also allows you to transfer securities from other investment platforms.You’ll complete a questionnaire that will determine your risk tolerance, investment goals and time horizon. But you’ll also have a web conference with a financial advisor, where more specific information will be gathered.

Your portfolio will be created based on your answers to the questionnaire, as well as the information provided to the financial advisor. Personal Capital Pros and Cons. Pros:. Budgeting and investment management on one platform: Personal Capital offers both personal financial management/budgeting, plus investment management on the same platform. Free financial dashboard: The Financial Dashboard includes a large number of investment tools as well as budgeting capabilities, and is free to use. It will also provide investment advice for accounts beyond your Personal Capital Wealth Management account. Tax optimization: The Wealth Management service uses extensive tax optimization strategies to minimize the income taxes generated by your investments.

Financial Advisors: The Wealth Management service provides two financial advisors for each client, who can help you manage your entire financial life. Socially responsible investing: If you consider yourself socially responsible and you want to make sure your investment align with your values, you can do that with Personal Capital. Cons:.

High minimum for Wealth Management: The minimum initial investment required for the Wealth Management service is $100,000, which will eliminate small and most medium size investors. Solicitation: If you sign up for the free version you will be solicited to upgrade to the Wealth Management service. Some users and readers have described this as “annoying”. High fees: The fee of 0.89% most investors will pay for the Wealth Management service is much higher than robo-advisors, like Betterment and Wealthfront, who charge from 0.25% to 0.40%. But it does need to be pointed out that Personal Capital provides investment management services closer to traditional human investment managers, rather than robo advisors. Limited budgeting capabilities: The budgeting capabilities of the platform are much more limited than fully dedicated budgeting apps, like Mint, Quicken and YNAB.FAQsQuestion: How do I know Personal Capital Wealth Management won’t trade my account just to generate fees for the company?Answer: Personal Capital is a fiduciary.

As such, they must act on behalf of your own personal interests. As well, there are no trading commissions, and no hidden fees of any kind. The annual advisory fee is the only fee you will pay.Question: Does Personal Capital’s Wealth Management advisory fee apply to all the investment accounts I have on the Financial Dashboard?Answer: Any accounts you link on the Financial Dashboard are included for free. The advisory fee applies only to the portion of your investments that are directly managed by Wealth Management.

For example, if you include a total of $1 million on the Financial Dashboard, but only $400,000 is managed by Wealth Management, the advisory fee will apply only to $400,000, not to $1 million. The Financial Dashboard can still be used to analyze your other accounts, and make recommendations. This includes any employer sponsored retirement plans you have.

Since Wealth Management doesn’t manage the account directly, there is no fee for including it in the Dashboard.Question: How does Personal Capital’s Wealth Management differ from true robo advisors?Answer: The Wealth Management service does use technology to manage your portfolio. That includes a large degree of automated investing, including periodic rebalancing. But Personal Capital departs from pure robo advisors in that they will customize your portfolio based on your own circumstances and preferences. For example, you do complete a questionnaire when you sign up for the service, just as you would for a robo advisor. But your portfolio allocation will also be decided by input from your financial advisor, based on your personal interview.Question: Why should I invest my money with Personal Capital when their annual advisory fee is so much higher than just about all the robo advisors?Answer: The higher fee with Personal Capital is due to a much higher service level. Not only do you have direct access to two financial advisors, who will help in both creating and modifying your portfolio going forward, but they’ll also provide holistic financial advice.

That means they’ll help you with financial decisions that go beyond your investment portfolio. This can include estate planning and help with other financial situations, such as a home purchase or buying the right amount of insurance. Robo advisors don’t provide that level of service. Should You Sign Up with Personal Capital?One of the factors that makes Personal Capital unique as a financial platform is that it operates as both a financial management service and an investment management service. Tom G.Thought provoking question: I’ve used their dashboard for a little over four years and am on my 4th ‘adviser’. Looking at their Linked-In profiles, the first three are now at different firms. Seems like high turnover but I suspect that’s the nature of the sales business.

I don’t mind them calling if they don’t mind my not picking up. =)Overall, great dashboard tool, but their business model needs some work if they think a high-wealth client is going to spend that kind of AUM% for a robo-advisor. SomeguyEveryone here is only complaining about the free service because they want to call you and get you into the paid. I asked them not to call, and they stopped it really was that simple so stop being a whiner. About a year after that I called them and signed up been happy ever since. Sure my returns are not as high due to the advisor fee (but still higher than those that charge 1-1.5%), and I’ve seen them sell a few stocks right before they tanked, and that tells me there is activity going on in the background to protect my interests.

They also helped me pick the right insurance, got everything I needed in order for estate planning, reviewed all my non-PC investment account (401k, ESOPs, etc) and identified which securities and ETF/MF’s to invest in to be inline with the overall diversification and risk level they helped me develop.I do not have the time to properly research or keep track of investments; so somebody looking out is ideal for me and I’ll pay for it. If you don’t want to pay for it, don’t but don’t come on here whining about a paid service you haven’t paid for. That’s like saying a restaurant has awful food but never have actually ate thereAs a disclaimer, I have over a 1M with PC and about 500k with other companies. MichelleI was looking for something I could balance my checking account, keep an eye on my overall spending, create a useful budget etc. After reading the glowing review regarding Personal Capital, I decided to give it a try.

The last budgeting software I used was Quicken. I tried everydollar, however it didn’t sync with my credit union.

Long story short, I was very disappointed with Personal Capital. At first I was very concerned about web based program requiring all of my passwords. Then accounts wouldn’t sync.

I didn’t see any useful budgeting tools. I just want to know where I’m spending my money and better manage my savings. This program gets an F grade from me!!! ZekeHello Michelle,I seldom make comment to an online post or opinion, however in this instance I must your comments regarding Personal Capital have no merit other than to point out your unrealistic expectations of an A+ company.Having used Personal Capital since 2012 I assure you Personal Capital is an OUTSTANDING company!

Their wealth management services are above reproach and their fiduciary commitment to their clients is second to none. SoYour comments indicate the company feel short of your expectaions. However, it is also apparent from your comments that your expectaions were not in keeping with the services the company provides.The review above, that apparently prompted your comments, clearly stated “If you’re looking only for a budgeting service, Personal Capital will not be the best choice. You’ll be better served by YNAB, Quicken or Mint.” And was100% correct in saying, “Personal Capital works for high net worth investors, who are looking for comprehensive personal financial management. They offer investment services comparable to robo advisors, but also provide direct big picture adviceIf you don’t have at least $100,000 to invest, you won’t be able to use the Personal Capital Wealth Management servicePersonal Capital has a real advantage over traditional human investment advisors, who charge anywhere from 1% to 1.5% to manage your portfolio. If you’re looking for a similar service level, but you don’t want to pay those high fees, Personal Capital is definitely the way to go.In short, Personal Capital is not a budgeting service.

The company is quite clear about their role as an investment and wealth manager. And again, in that role they are second to none.Sincerely Submitted,Zeke. 2017LeePMy experience is that they are extremely responsive to any time you log in to their system (you will get a call the moment you log in) when they are trying to sell you; however, when you do open an account and are provided access to two (2) advisors, they are still spending most of their time calling the Users who have not yet signed up for the service and are just using the software for free. Have been using their actual services for nearly a year now.

I am below combined returns over period of time, i.e. My performance is worse than S&P, foreign and bonds (their measurements), you need to make an appointment to speak with someone and it can take a week or more, and the last time I spoke with my “advisor” they passed nothing on to the individual who actually manages my account. Absolutely nothing. I am going to move, I just haven’t figured out where yet. 2017LeePMy experience is that they are extremely responsive to any time you log in to their system (you will get a call the moment you log in) when they are trying to sell you; however, when you do open an account and are provided access to two (2) advisors, they are still spending most of their time calling the Users who have not yet signed up for the service and are just using the software for free.

Have been using their actual services for nearly a year now. I am below combined returns over period of time, i.e. My performance is worse than S&P, foreign and bonds (their measurements), you need to make an appointment to speak with someone and it can take a week or more, and the last time I spoke with my “advisor” they passed nothing on to the individual who actually manages my account. Absolutely nothing.

I am going to move, I just haven’t figured out where yet. When searching for reviews of PC, I mostly see reviews of the free software and not on the actual performance of the services provided for the higher fees.

Discussion, yes, of what you get for a higher fee, but no actual reviews of the quality of the services. RandyI am pleased to find these more candid comments about Personal Capital.

I’ve been using Quicken for nearly 40 years. Rob Berger’s glowing review of PC as a substitute for Quicken caused me to take a look.I agree with the praise for the beautiful screens and the investment overview. I was not pleased, to say the least, with the incessant phone calls pressuring me into subscribing for their premium service. Moreover, I was alarmed to learn that their sales agents had complete access to all details of the financial data that I had entered into PC. What’s more, I found it very lacking in ability to manage standard day to day bill payments. I have since closed my PC account and am sticking with Quicken, at least until I find a replacement that serves my needs.

Joseph T BusfieldEveryone likes Personal Capital – except me. After trying PC for a while, I started receiving sales calls for their “financial advisors” services. Apart from being being bitten twice by financial advisors and being happy with self directed Vanguard funds in my SEP, I was not inclined to give up almost 1% for services. And they wanted me to move at least a quarter of my savings to PC so they could invest in individual stocks they thought worthy. I deleted my account to stop the annoying calls. So far so good. Beware, be very aware of the sales goals!!

RikkThe platform is excellent, the best I’ve seen of its type. Much like Mint only better in a number of areas. But I was continually uncomfortable with the idea of allowing access to my login information. The frequent hacking of reputable, well-known companies with longer histories than Personal Capital only exacerbates that discomfort. When you add in the nagging to become a premium member, to take calls with an advisor, to meet in person etc this became more trouble than it was worth. I like the platform, specifically the ability to have all accounts viewable in one place, but the tradeoffs were too high.

Possibly better off with Banktivity (used to be iBank) for Mac or a Quicken or similar for PC. Advertiser Disclosure: This site may be compensated in exchange for featured placement of certain sponsored products and services, or your clicking on links posted on this website. The credit card offers that appear on this site are from credit card companies from which doughroller.net receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Doughroller.net does not include all credit card companies or all available credit card offers.

These days, it can be difficult to stay organized financially. You may have multiple bank accounts, credit cards, a 401k and various individual retirement accounts. You may have a mortgage, auto loan and student loans.

It’s all very difficult to keep track of, and you likely don’t have the patience to sign in to multiple accounts or remember countless logins and passwords.Fortunately, there are solutions out there to help you maintain these accounts in a more streamlined way. These are commonly referred to as “account aggregators” and they can make your life a lot easier.

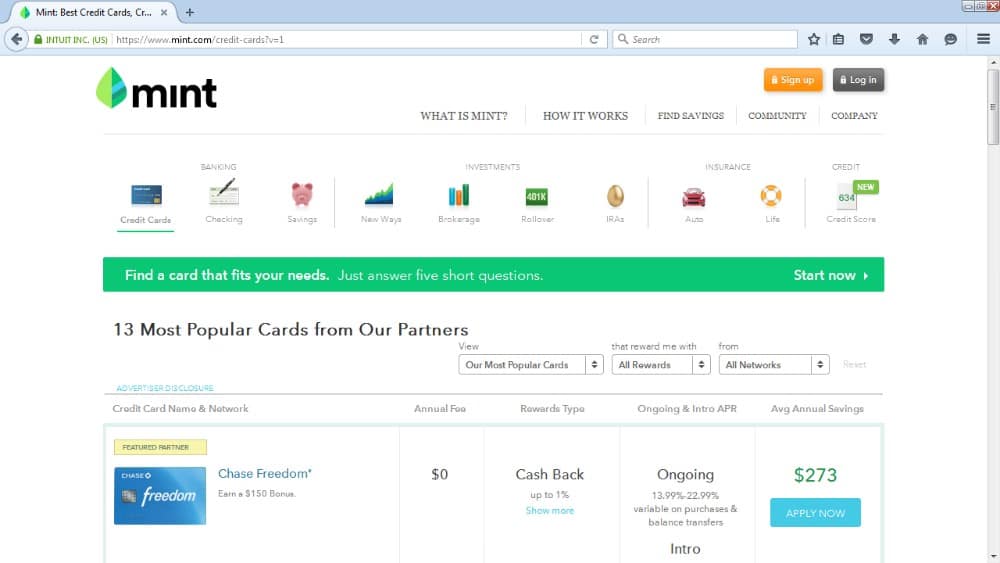

They may even offer some helpful budgeting and investment analysis tools.In this article, we’ll review two of the most popular account aggregators:. We’ll walk through the features of each service and give a sense of which is better at certain tasks.I have personal experience with both services but use Mint more frequently, for no other reason than I discovered it first and have been using it for a longer period of time. There are some strong similarities between the two solutions, but they also have some meaningful differences.In short, Personal Capital gears itself to users who want to track and manage their investments, while Mint is better as an overall budgeting and personal finance tool. That said, everyone’s personal financial situation and needs are different, and because each service is free, there’s no reason you can’t try each for yourself to see which is a better solution for you.

Table of Contents.The Basics of Mint and Personal CapitalOn the surface, Mint and Personal Capital are very similar in what they do. Both allow you to log in to a website or smartphone app and see the account information and balances of your bank accounts, loans, credit card accounts, investment accounts and more. You can also view transactions, set up budgets and get a full picture of your financial situation in a single dashboard on both. Both account aggregation services are free.Mint is owned by Intuit, the maker of finance software and solutions such as TurboTax and Quicken. This means that there is some nice integration if you use these other programs. (I use TurboTax for my taxes.) It also means that Mint is backed by a reputable company with deep resources for making sure your information is safe.Personal Capital is its own company, but makes its money through a paid investment service that has more than $8 billion worth of assets under management. It is registered with the Securities and Exchange Commission as an investment adviser.

This is a very important distinction, as it means that customers over a certain net worth may be contacted by the company’s sales team.One interesting thing to note is that Bill Harris, the founder of Personal Capital, was once the CEO of Intuit. Signup and SetupI did not find a meaningful difference in the ways that Personal Capital and Mint get you started once you decide to use their account aggregation dashboards.For both services, it’s easy to open an account with an email address, a password and a phone number. The phone number is used to send you text messages in case you get locked out of your account or want to set up two-factor authentication.Linking outside accounts is simply a matter of entering the login information and passwords for those accounts. In most cases, it takes a couple of minutes for an account to sync. Each time you log in, you may have to wait some time for accounts to update. The more accounts you have linked, the longer it will take. Some financial institutions sync more quickly than others.It is important to note up front that Personal Capital does not advertise itself as an account aggregator alone.

The company makes its money from a paid managed investing service, which is prominently advertised.A new customer may not even be aware that you can sign up for the free aggregator service. From a marketing standpoint, the paid and free services appear to be lumped together as one.In fact, when signing up for Personal Capital, the company literally says, “Once you have linked your accounts, schedule a free consultation with a Personal Capital Advisor.” Be warned: this consultation is indeed free, but from my experience it comes with a very heavy sales pitch for the paid service.

While there is no obligation to sign up for the paid service to use the account aggregator, it’s easy to see how someone might get the impression that there is.Mint, on the other hand, is clearly an account aggregator and nothing more. Thus, there is no confusion as to what it’s offering, so the signup process is generally more straightforward.Edge: Mint Tracking and BudgetingPerhaps the most important feature of Mint and Personal Capital is the ability to see every financial transaction you make (cash transactions excepted) as long as you sync all of your bank, investment and credit card accounts.This allows you to get a nearly complete view of your spending. All transactions are categorized and labeled, and the log is customizable based on what you want to see. For the most part, this aspect of Personal Capital and Mint are nearly identical. Personal Capital’s interface is a bit cleaner, but I found Mint to be smarter when it came to categorizing transactions accurately.Using this transaction information, both services offer budgeting tools, allowing you to see how much you are spending on specific categories.

For example, you can see a pie chart outlining your spending on entertainment and fast food over the previous six months.One of my favorite features is the ability to see how much you spent in specific categories from one time period to another, as this allows you to know precisely where you may be able to cut expenses.This is one area where I believe Mint excels. Its budgeting charts are more comprehensive and easier to follow than Personal Capital’s.

Moreover, Mint allows you to enter very specific spending goals (like saving for a car or other large purchase) and will update you on your progress over time.Mint also offers access to your credit score for free, which is a nice feature not available on Personal Capital.Edge: Mint SynchronizationOne of the challenges that all account aggregators face is ensuring that all of your accounts update and link without a hitch. It’s not uncommon to log in to one of these services and find that one of your bank or brokerage accounts didn’t sync properly.

This is especially true if you haven’t logged in for awhile. To get things fully linked up may require you to re-enter the login and passwords for some accounts.From my experience, Personal Capital does a better job of keeping accounts linked. It uses a service called Yoodlee to sync accounts, while Intuit uses an in-house solution that is inferior, in my opinion.Edge: Personal Capital Analyzing InvestmentsBoth Personal Capital and Mint allow you to access investment accounts. By clicking on the individual accounts you can see the performance of entire portfolios and the list of the individual holdings.

This includes investments in your and.In the case of Mint, charts show the performance of your entire portfolio over seven different time frames, but not the performance of the individual stocks.Personal Capital, on the other hand, will not only show charts of the performance of accounts and your entire portfolio over time, but the individual investments themselves. It has helpful charts showing them against benchmarks, and also shows the breakdown of how your investments are allocated to the 11 key stock market sectors.Because Personal Capital makes its money from a separate robo-advising service, it is clearly designed with investors in mind. The interface is clean and bright, the navigation is easier, and the information is comprehensive. There are quality tools for portfolio analysis and retirement planning, and even a Retirement Fee Analyzer that outlines the long-term impact of fees in your retirement account.The investment information on Mint, meanwhile, is more spare and does not have the same slick design.For users who are most interested in checking their investments regularly, Personal Capital is the much better option. It’s a helpful tool for as well as investors who are more advanced.Edge: Personal Capital Mobile AppsBoth Mint and Personal Capital offer free mobile apps for the iOS and Android platforms. For the most part, the apps offer the same functionality as the web platforms.

Neither service excels over the other in this department.Edge: Tie AlertsDo you want to receive a summary of your transactions via email? Do you want to be alerted when a bill is due? This is an area were Mint shines. Mint offers customized email alerts for a wide variety of things.

You can get an alert when your bank account balance drops below a certain level, or if you exceed your budget in a certain spending category. You can also be alerted if your credit score changes.Personal Capital does not offer individualized email alerts, though you can subscribe to receive general articles and advice.Edge: Mint SecurityOne of the biggest concerns of any user of account aggregators should be security. The last thing you want is for someone to access a view of all their accounts. Robust security standards are essential for cloud-based operations such as these.It’s understandable why many people shy away from using these services, and let’s say this up front: No service can offer a 100% guarantee that your data is safe. That said, Personal Capital and Mint use strong security that’s on par with or better than most financial institutions.Mint uses 256-bit encryption for your login information, and the data exchanged with Mint is encrypted with 128-bit encryption. This makes it essentially impenetrable from a brute force attack. It also uses Verisign for security scanning and partners with BugCrowd on security audits.Personal Capital uses 256-bit encryption on all sides.

The site got an A+ rating for its encryption from Qualys SSL Labs. It’s notable that Personal Capital was founded by Bill Harris, who once led Passmark Security, a leader in web authentication technology.With Personal Capital, you can also sign up for a daily transaction monitor via email, making it easier to spot any suspicious transactions. Also, it requires validation from a second device any time you try to access an account from a new machine. So for example, if you typically log in from home but attempt to log in on your work computer, you will be prompted to enter a code you receive via text or email.Mint and Personal Capital each use a four-number PIN for access to apps on Android and iOS smartphones, as well as the option for Touch ID or Face ID. Two-factor authentication is available on both services.Both services have high levels of security and neither has been victimized by a major data breach. But Personal Capital has a stronger encryption and some other nice features.Truth be told, however, the security of your Mint and Personal Capital accounts comes down to you.

Don’t use easy-to-guess passwords, share your login information with others, or leave the websites open on public computers.Edge: Personal Capital Customer ServiceEvery once in a while, you may encounter a problem when logging in to your Personal Capital or Mint accounts. Perhaps an external account won’t link properly, or information appears to be incorrect. This is where it helps to have access to customer service.Personal Capital has a Frequently Asked Questions section and a help section powered by Zendesk.

You can also send your customer service question through a webform, but it’s not easy to find on the Personal Capital website.Mint’s customer service is managed similarly through NanoRep.Neither site appears to offer a direct phone number for customer service, though Personal Capital has a number to reach a financial adviser.Edge: Tie Financial Advice and Other ContentBoth Mint and Personal Capital produce written content offering financial advice and tips. The quality and usefulness of the content varies, but the articles are generally a nice supplement to the basic services.Personal Capital will link to articles on its Daily Capital blog, usually written by its own certified financial advisers. (I’ve found its Weekly Market Digest to be particularly well-crafted and insightful.) Personal Capital also has a Research and Insights section with longer articles.

Examples include, “Personal Capital’s Guide to Investing in Volatile Markets,” and, “How to Save and Spend for Retirement.”Mint offers similar articles in its blog, but most of the content is written by third-party bloggers rather than financial advisers, so the quality varies. Mint also delves into more personal finance topics, whereas Personal Capital is focused more on investing.Both services have good content that is a nice complement to the free services. But I have found Personal Capital’s content to be of slightly higher quality, especially with regard to investing articles written by certified financial planners.Edge: Personal Capital Intrusiveness of Ads and PitchesMint and Personal Capital are free services. They each make their money from other products and services. For this reason, both services will force you to endure some pitches that may seem intrusive.Mint is part of Intuit, the maker of TurboTax, Quicken, and other financial software.

Thus, you will often see advertising for these programs. Additionally, you will see many paid promotions for credit cards.Personal Capital makes its money from a separate paid managed investing service. Once you sign up for a free account on Personal Capital, the solicitations to sign up for the investing service will be frequent, especially if you are of high net worth.The solicitations from Personal Capital will also sometimes be direct in the form of phone calls, though sometimes they are more subtle. For instance, the company will send you a message congratulating you on receiving a free session with one of its advisers. It will even provide you with several suggested dates and times.Make no mistake: This is an attempt to get you to sign up for their paid service. While there is no obligation to sign up for the paid investment service to use Personal Capital, the urging is there.Full disclosure: I explored Personal Capital’s paid service for my investments and spoke with an adviser at length, but ultimately decided it was not a good fit for me personally.

It’s possible that others may find it to be helpful for their needs.Everyone has their own tolerance for advertising and solicitations, and they are the price to pay for getting something for free. I personally found Personal Capital to be a little pushier and somewhat deceptive, whereas Mint’s advertising was a little easier to ignore.Edge: Mint The Limitations of Account AggregatorsAccount aggregators such as Mint and Personal Capital let you get a full view of your financial situation, but they can’t do everything. Even if you have all of your accounts linked and up to date with the aggregator, you will still likely need to log in to the individual accounts to perform certain tasks. Mint and Personal Capital aren’t designed to completely eliminate any need to log in to the websites or mobile apps of your bank or brokerage. Here are some of the key limitations:Account aggregators don’t offer the ability to move money around. For example, you can check the balance of your savings account, but can’t move money from one bank account to another.

You Can’t Make TransactionsYou can check the movement of your investments, but won’t be able to trade stocks. However, you can see the balance of your credit card bill, but won’t be able to send a payment. (Mint once offered a bill pay service, but shuttered it in 2018.)Labeling of Transactions is ImperfectAccount aggregators allow you to see all of your monetary transactions in a single view, and will help you budget by labeling transactions based on what they are. So for example, a purchase of movie tickets might be labeled “entertainment.”But neither Mint nor Personal Capital pulls this information from the originating institution and is only as perfect as the bank or credit card company. And some institutions do a better job of this than others. In other words, garbage in, garbage out.

(For example, I recently bought some running shoes that came up as “Pet Supplies.”)Thus, if you really want a complete look at the breakdown of your transactions, you need to do a lot of manual editing, and this can take time. The good news is that both allow for customized labeling of any transaction.Some Accounts Will Never Link Due to SecurityMost account aggregators will link to outside accounts simply by saving the login and password information. But this becomes hard or even impossible if the outside account has an enhanced security procedure, such as two-factor authentication. With two-factor authentication, the account requires the user to enter the username once and then receive a password on a separate device.Account aggregators struggle with this and may not link the account if two-factor authentication is activated. You may be able to get around this by disabling two-factor authentication on the account, but then you lose the benefit of enhanced security.

Personal Capital Vs Mint

(And some accounts make two-factor authentication mandatory.) The Bottom LineSo should you sign up for Mint or Personal Capital? Which is better overall?In the end, there is not much difference between the two services, and both are fine solutions for anyone looking to get a full view of their financial situation. Both services have a robust array of features, are easy to use, and offer good security.Personal Capital may be the preferred solution if you want to track investments. Mint, on the other hand, may be a better option if you are more interested in simply tracking spending.There’s no downside to trying both services.

You may find that you will settle into using one more than another over time. Or you might decide to use both: for investing and Mint for spend tracking and budgeting.Have you used Mint or Personal Capital? If so what was your experience? Please share your thoughts on the Well Kept Wallet Facebook page.